- Tracking the Trade Weekly Market Review

- Posts

- Your Weekly Market GPS - Army parades, Iran bombs and Fed Meetings

Your Weekly Market GPS - Army parades, Iran bombs and Fed Meetings

Where geopolitical chaos meets your portfolio's reality

Where geopolitical chaos hijacks your portfolio faster than a Black Friday sale

🌅 The Week Ahead

Alright, thrill-seekers, if you thought last week was loaded, buckle up: June 15th’s weekend special served us a 250-year Army birthday bash and Israeli airstrikes that shot oil prices higher than Tom Cruise on Oprah’s couch. Feels like watching a Marvel blockbuster while holding your 401(k) hostage—popcorn good, stress balls mandatory, and maybe something stiffer for medicinal purposes.

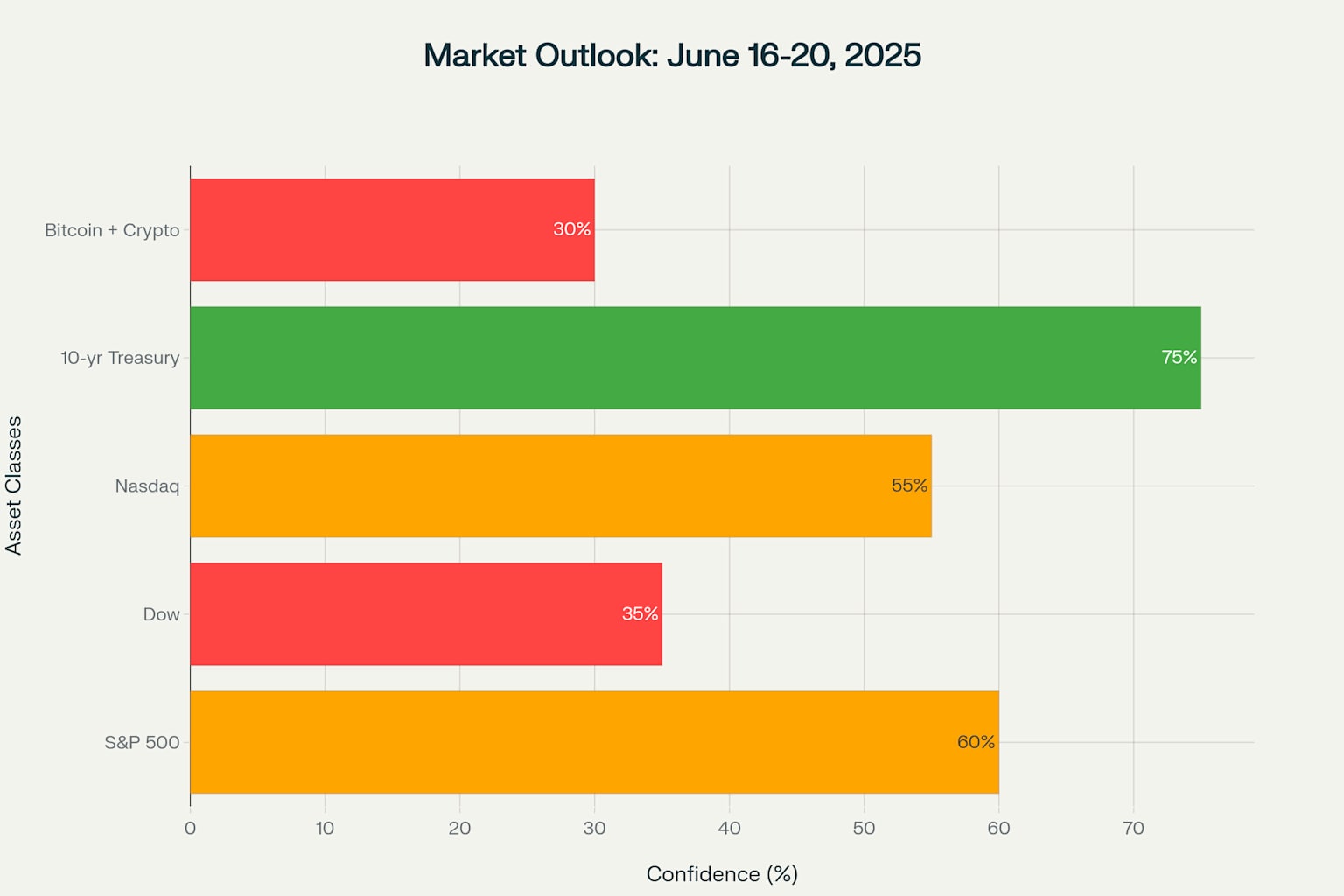

📈 Market Outlook Cheat Sheet

Major indices stare at this week like a cat downs a cucumber—equal parts curiosity and terror. Friday’s sell-off was brutal: Dow tumbled 770 points, S&P slid 1.1%. Yet consumer sentiment surprised us by doing a backflip to 60.5 from 52.2. Because nothing says “I feel great” like ignoring a warzone.

Asset | Mood | Why It Might Move |

|---|---|---|

S&P 500 | Cautious | Iran spooked Friday (-1.1%), Fed’s Wednesday drama, but consumers still smiling at 60.5 |

Dow | Bearish | Defense stocks up, but lost 770 points; Trump’s tariff tea leaves still brewing |

Nasdaq | Cautious | AI hype vs. geopolitical heartburn—tech’s not invincible, folks |

10-yr Treasury | Bullish | Safety play as missiles fly; yield ~4.37%, Fed tone likely “we’re chillin’” |

Bitcoin + Top 3 Alts | Bearish | BTC dipped below $105K, $450M token dumps incoming—risk-off feels mighty on-brand |

🪙 Gold & Precious Metals Watch

Gold’s strutting in Monday morning at $3,453/oz, up 1.48%, as investors embraced “shiny shield” mode post-Operation Rising Lion. With the Middle East hotter than your summer electric bill, precious metals are gleaming brighter than a freshly detailed Tesla at Silicon Valley valet. Classic flight-to-safety choreography.

🏡 Real-Estate Roundup

Housing starts: 1.36M in April (↑1.6% MoM, ↓1.7% YoY). Mortgage rates stubbornly at 6.65%, home prices still climbing like your phone bill. Commercial real estate tiptoes through tariff-triggered uncertainty, while multifamily keeps calm and carries on, thanks to a housing shortage that refuses to quit.

🔑 Top Weekend News

Army’s 250th Birthday Parade & Protests (June 14): A $45 M military spectacle featuring 6,600 troops, 150 vehicles—and a thunderstorm—drew both cheers (defense stocks got a polite golf clap) and the largest protests since Trump’s second term kickoff, as millions rallied against the parade’s cost and recent ICE raids. Markets shrugged—until they didn’t.

Israel Strikes Iran (June 13): Operation Rising Lion sent 200+ jets and 330+ munitions at Iran’s nukes. Top IRGC brass went boom, and oil shot up 8%. Largest strike since the Iran-Iraq War—no popcorn required, we’re all on edge.

Iran’s Retaliation (June 15): Tehran fired missiles and drones; U.S. intercepts in red alert. Nuclear talks in Oman got ghosted thanks to rising “fireworks.”

G7 Summit in Canada (June 15–17): Kananaskis meets Tariff Theatre: Trump’s tariffs vs. allied eye-rolls. Canada’s G7 presidency hits 50—time for some policy birthday cake.

Consumer Sentiment (June 13): U of Michigan index jumps to 60.5 from 52.2—first rally in six months. Still 20% below Dec 2024’s party levels. Shout-out to Americans mastering the art of tariff-resilience.

US-China Trade Framework (June 11): London negotiators sketch a rough draft; Trump and Xi need to sign off. Rare earths and chips remain the spicy bits.

Tariff Inflation (June 11): May CPI rose just 0.1% vs. 0.2% expected. Core inflation also only 0.1%. Fed breathing easier—tariffs not quite crashing the party… yet.

🏦 Central-Bank Radar

Powell takes the stage Wednesday after keeping rates at 4.25–4.5%. Dot plot drama incoming as policymakers juggle tariff-fuelled inflation vs. growth concerns. Expect cautious vibes and maybe a wink at future rate hints.

Day/Date | Event | Why You’ll Care |

|---|---|---|

Tue (June 17) | FOMC Day 1 | Tariff tea, inflation chatter, and maybe some Fed finger-pointing |

Wed (June 18) | Rate Decision 2:00 PM | Hold expected, dot plot tweak, Powell’s post-game at 2:30 PM |

Thu (June 19) | Juneteenth Holiday | Federal holiday—markets closed, brunch optional |

Fri (June 20) | Nothing Major | After-party hangover—eyes on next week’s data |

💼 Earnings Spotlight (5 Names to Watch)

Light week thanks to Juneteenth, but homebuilders and consumer plays deliver intel on tariff fallout.

Day/Date | Company (Ticker) | Watch For |

|---|---|---|

Mon (June 16) | Lennar (LEN) | Material costs vs. margin magic |

Tue (June 17) | Jabil (JBL), La-Z-Boy (LZB) | Supply-chain headwinds and comfy furniture demand |

Wed (June 18) | GMS Inc (GMS) | Building-supply inflation—who’ll blink first? |

Thu (June 19) | Markets Closed | Juneteenth—sip responsibly |

Fri (June 20) | Kroger (KR), CarMax (KMX), Darden (DRI) | Grocery prices, second-hand car frenzy, and dinner-out trends |

🗯️ Social Buzz

Twitter’s ablaze with #IranIsraelWar, #Fed, and #Bitcoin. WallStreetBets can’t decide between defense stock YOLOs and gold “diamond hands.” StockTwits is all small-cap doom with a splash of energy-bull optimism. Translation: everyone’s wildly confused but trading anyway.

Summing It Up

If last week was wild, this one’s on steroids. From Iran’s missile fireworks to Israel’s air-show, your portfolio’s starring in a geopolitical action flick. Wednesday’s Fed meeting is the season finale: interest-rate plot twists and Powell’s exclusive director’s cut. Think Game of Thrones, minus dragons and with extra economic jargon. Popcorn’s optional; life-vest your positions, grab something stronger, and may your stops be as tight as your sense of humor.

🍷 Wine & Dine

Made it this far? Reward yourself:

Wednesday’s Fed Day: Robust Cabernet and nervous giggles.

Thursday’s Juneteenth: Mimosas and CNBC reruns (every sip counts).

Friday’s Earnings: Whiskey—neat, just like your portfolio should be.

🔍 One More Thing

Tesla’s robotaxi tease on Sunday (June 22) in Austin—Elon says “maybe soon.” If it lands, expect a tech rally cameo once markets stop hyperventilating over missiles.

⚠️ Financial Newsletter Disclaimer ⚠️

Entertainment + education only—definitely not advice (unless you count my dog’s Bitcoin predictions—she only barks at anything that doesn’t smell like treats). Past performance ≠ future results, especially when Iran and Israel treat geopolitics like ping-pong. Always consult a pro before you YOLO your life savings.