- Tracking the Trade Weekly Market Review

- Posts

- S&P's Best May in 35 Years Sets Stage for June Fireworks

S&P's Best May in 35 Years Sets Stage for June Fireworks

Tariff drama, Fed tea leaves, and earnings season heat up

Good Morning and Happy Monday!

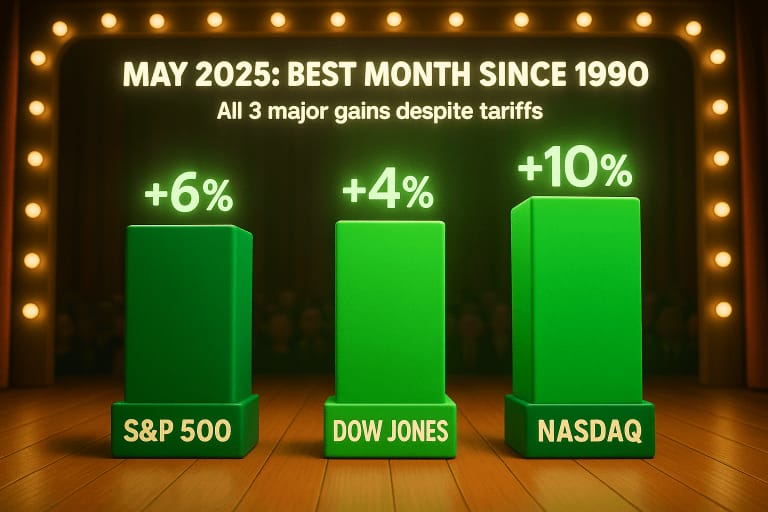

Like Taylor Swift's Eras Tour, May was all about the comebacks—S&P 500 notched its best month since 1990 with a stunning 6% rally. But before you start planning your yacht purchase, remember that tariff tantrums and Fed flip-flops are still lurking like plot twists in a Marvel movie. Buckle up, traders—June's about to serve us drama with a side of volatility.

Market Outlook (Week-Ahead Cheat Sheet)

The major indices posted exceptional gains in May, with technology leading the charge. However, several key events could shift momentum as we enter June.

May 2025 marked the S&P 500's best month since 1990, with all major indices posting substantial gains despite ongoing tariff uncertainties

Asset | Mood (Bullish/Cautious/Bearish) | Why It Might Move |

|---|---|---|

S&P 500 | Cautious | Powell speaks Monday; jobs data Friday could shift Fed timeline |

Dow | Bullish | Defensive tilt as tariff noise continues; 4% May gain momentum |

Nasdaq | Cautious | 10% May surge faces Broadcom earnings test Thursday |

10-yr Treasury | Cautious | Yield at 4.42%; Powell remarks could move bonds either way |

Bitcoin + Top 3 Alts | Bearish | BTC at $105K but crypto conference dump pattern intact |

Gold & Precious Metals Watch

Gold glittered Friday with a 1.4% surge to $3,315 per ounce, as traders sought safe havens amid tariff turbulence. The shiny metal's up 25% year-to-date, proving once again that when geopolitics get messy, gold gets busy. Silver followed at $33.27, maintaining the gold-to-silver ratio near 100.

Real-Estate Roundup

Mortgage rates played a game of limbo, with the 30-year fixed rate hovering between 6.84% and 6.94%—still stubbornly high but showing a modest retreat. The housing market remains in "expensive hibernation" mode as buyers wait for rate relief that may not arrive until fall.

Top Weekend News

Trump Raises Steel/Aluminum Tariffs to 50% (May 31): Fresh trade war fears as President doubles down on protectionism.

Canadian Wildfires Choke Midwest Air Quality (June 1): Environmental concerns could impact outdoor economic activity

Nvidia Q1 Crushes Expectations (May 29): 69% revenue growth to $44.1B keeps AI dreams alive

PCE Inflation Continues Cooling (May 30): Fed's preferred gauge eases, but rate cut timing remains murky

Appeals Court Reinstates Tariffs (May 29): Legal ping-pong continues as trade uncertainty persists

Central-Bank Radar

Fed Chair Powell headlines Monday's speaking calendar as markets seek clues for a rate cut. With jobs data on Friday, this week's Fed-speak could set the tone for summer positioning.

Day/Date | Speaker/Decision | What to Watch For |

|---|---|---|

Mon (June 2) | Powell, Logan, Goolsbee | Tariff impact commentary; labor market assessment |

Tue (June 3) | Logan, Goolsbee | JOLTS data reaction; inflation progress views |

Wed (June 4) | Bostic, Fed Beige Book | Regional economic conditions; Fed Listens event |

Thu (June 5) | Harker | Pre-jobs report positioning |

Fri (June 6) | Jobs report reaction; market digest mode |

Earnings Spotlight

Day/Date | Company (Ticker) | What to Watch For |

|---|---|---|

Mon (June 2) | Campbell Soup (CPB) | Food inflation impact; $0.65 EPS target |

Tue (June 3) | Dollar General (DG) | Consumer spending health; $1.48 EPS estimate |

Wed (June 4) | Dollar Tree (DLTR) | Discount retail strength; margin pressures |

Thu (June 5) | Broadcom (AVGO) | AI chip demand follow-up to Nvidia's blowout |

Thu (June 5) | Lululemon (LULU) | Athleisure trends; international expansion |

Reddit's r/stocks crowd remains surprisingly chill about tariff drama, with users betting markets have "moved past concerns". Bitcoi” Bitcoin Twitter less optimistic as BTC conference curse strikes again. GameStop is still trending, but the earnings delay until next week keeps meme energy in check.

One More Thing

Tesla is down 25% since December, but Musk's departure from the company sparks hope for a renewed focus. Sometimes the best CEO move is just showing up to work.

Wine Pairing

If you make it this far, treat yourself.

Powell speaks Monday? Pair with a nervous Pinot Noir and bite your nails through jobs Friday. For Broadcom earnings Thursday, nothing beats a bold Cabernet—you'll need the confidence boost if those AI chip numbers disappoint.

Wrapping it Up

May proved that even when markets looked ready to crater (hello, 300-point Dow dive), the bulls weren’t done dancing yet—classic “summer rally” vibes in full swing. But June’s first week menu is spicy: Fed speakers, earnings heavy-hitters, and that all-important Friday jobs report could flip the script faster than a TikTok trend. So keep your coffee strong, your stops tighter, and remember—in markets as in life, the only constant is change (and the occasional tariff tweet).

"Trade smart, stay caffeinated, and see you next Time!"

Social Buzz